CRYPTOSTAKINGADVISOR

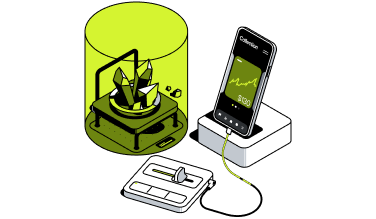

Ensure the stable growth of your staking profits by delegating tasks such as validator analysis, as well as commission and risk assessment with this tool.

progress bar

Stage

$0 / $0

CRYPTO STAKINGADVISORFEATURES

CRYPTO STAKINGADVISORFEATURES

01.AUTOMATIC STAKING POOL SELECTION

Evaluate the potential profitability of staking pools, determine whether validators are reliable, and get end-to-end analytics of the safety of smart contracts.

02.MULTI-BLOCKCHAIN SUPPORT

Find the best opportunities in Ethereum 2.0, Polkadot, Cardano, and other PoS-based blockchains.

03.NET PROFIT CALCULATION

Consider validator fees, token inflation, and lockup periods to make your strategy applicable to real-world conditions.

04.VALIDATOR RATINGS

Evaluate uptime, geographical distribution of nodes, and operator reputation to avoid being deceived by scammers.

Benefits

CRYPTO STAKING

CRYPTO STAKING

ADVISOR

Benefits

Optimize your profits

Use built-in AI algorithms to choose validators with the highest earning potential.

Smart risk management

Get a full analysis of fees, validator reliability, and market conditions in a few moments.

Secure your assets

Receive notifications, calculate profit potential, and benefit from hardware wallet support.

SIMPLIFY YOURTRADINGACTIVITIES WITHWITHCRYPTOSTAKINGADVISORTHROUGHAUTOMATIONAND AI!

buy $wai Frequently

Frequently

Asked Questions

What algorithms does this tool use to select the best validator?

It analyzes hundreds of validators by APR, fees, uptime, reputation, smart contract reliability, and several other parameters to generate a list of those that carry minimal risks.

What blockchains is this tool compatible with?

Crypto Staking Advisor supports Ethereum 2.0, Polkadot, Cardano, Solana, and other Proof-of-Stake blockchains. This, in turn, makes it possible to maximize the diversification of crypto assets and increases the overall reliability of your staking strategy.

What is the benefit of automatic re-evaluation of validators?

The tool regularly recalculates the profitability and reliability of validators, determining the risks for each of them and thereby updating the rating every N hours. Thus, if any of the validators get lower or, conversely, higher positions in the rating, you will receive a corresponding notification and recommendations for alternatives.

How is the potential profit from staking calculated?

Using data from an analysis of current yield rates, validator fees, token inflation, and lockup duration, this tool automatically calculates income for 7, 30, or 365 days.